Imagine yourself comfortably settled in your dream home, but then comes the shock of an unexpected property tax bill. Such surprises can turn homeownership from a dream into a stressful juggling act. That’s why it’s crucial to understand every component of your mortgage payment – not just for peace of mind but for financial planning and stability.

In this comprehensive blog post, we’ll help you understand all aspects of your mortgage payments. By the end, you’ll have a clear understanding of whether property taxes are lurking in your monthly payments and how this impacts your financial health as a homeowner.

Table of Contents:

- What’s Really in Your Mortgage Payment?

- Are Property Taxes Included In Mortgage Payments?

- Escrow Accounts Explained

- When Are Property Taxes Not Included?

- Is It Worth Including Property Taxes in Your Mortgage Payments?

- How to Determine If Your Mortgage Includes Property Taxes?

What’s Really in Your Mortgage Payment?

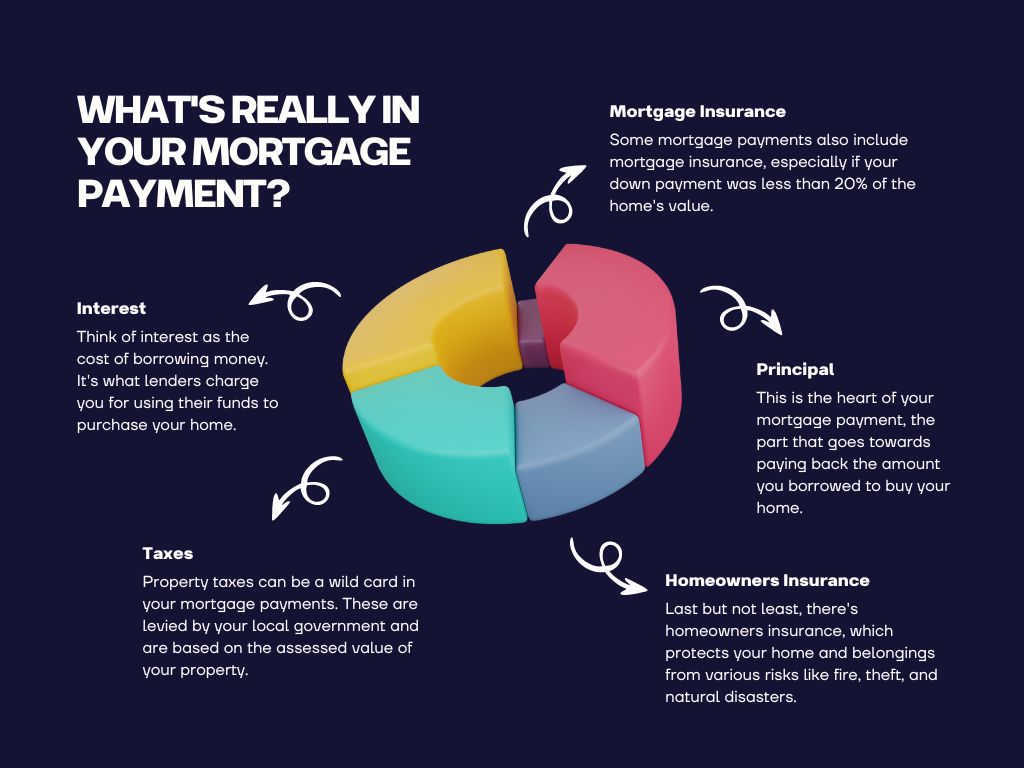

Mortgage payments, they can be as layered and complex as a gourmet lasagna. At their core, most mortgage payments consist of four key ingredients, commonly known by the acronym PITI: Principal, Interest, Taxes, and Insurance.

- Principal – This is the heart of your mortgage payment, the part that goes towards paying back the amount you borrowed to buy your home.

- Interest – Think of interest as the cost of borrowing money. It’s what lenders charge you for using their funds to purchase your home.

- Taxes – Property taxes can be a wild card in your mortgage payments. These are levied by your local government and are based on the assessed value of your property.

- Insurance – Last but not least, there’s homeowners insurance, which protects your home and belongings from various risks like fire, theft, and natural disasters.

Some mortgage payments also include mortgage insurance, especially if your down payment was less than 20% of the home’s value.

Are Property Taxes Included In Mortgage Payments?

Property taxes are an integral part of homeownership. They fund essential community services like schools, roads, and emergency services. The amount you pay is determined by your property’s assessed value and the local tax rate.

But here’s where it gets interesting: in many mortgage arrangements, property taxes are included in your monthly payment and handled through an escrow account. This is both a convenience and a safeguard. It ensures that taxes are paid on time, avoiding penalties or, in the worst-case scenario, a tax lien against your home.

However, including property taxes in your mortgage payment does have its trade-offs. While it simplifies budgeting and ensures timely payments, it can also make your monthly payment higher. Plus, since tax rates can change, your payment might fluctuate over time.

Escrow Accounts Explained

An escrow account is like a trusty financial sidekick for homeowners. It’s an account set up by your lender where a portion of your monthly mortgage payment is deposited to cover property taxes and homeowners insurance. The lender then uses these funds to pay your taxes and insurance on your behalf. This arrangement is particularly beneficial for ensuring that these critical bills are not overlooked.

However, the lender’s role in managing this account can be a double-edged sword. On one hand, it’s convenient and reduces the risk of missed payments. On the other, it means relinquishing some control over the timing and disbursement of these funds.

When Are Property Taxes Not Included?

While many homeowners have their property taxes neatly wrapped into their mortgage payments, there are situations where this isn’t the case. Understanding these scenarios is key to managing your finances effectively.

One common scenario is when you have a mortgage without an escrow account. In this setup, the responsibility for paying property taxes falls squarely on your shoulders. This situation is more common with certain types of loans, like some conventional loans with more than 20% down, or if you’ve requested to have your escrow waived.

As a homeowner, handling your property taxes independently requires diligence and foresight. You need to:

1. Know Your Tax Amounts: Keep abreast of your property tax rates and assessments. These can change, so stay updated.

2. Budget Wisely: Consider setting aside a portion of your monthly budget in a separate savings account earmarked for taxes. This way, when taxes are due, you’re not caught off guard.

3. Meet Deadlines: Be aware of when your property taxes are due. Late payments can lead to penalties, interest, or in extreme cases, a lien against your home.

4. Understand Payment Options: Many local governments offer different ways to pay your taxes, such as online payments, checks, or even payment plans.

Is It Worth Including Property Taxes in Your Mortgage Payments?

Incorporating property taxes into your mortgage payments can seem like a simple solution, but it’s a decision that comes with its own set of pros and cons.

Pros:

- Simplicity: It’s one less bill to worry about. Your lender takes care of everything.

- Budgeting Ease: Spreading the cost of your annual property taxes over 12 months can make budgeting easier.

- Lender Assurance: Lenders often prefer this method as it assures them that the property taxes are being paid, protecting their investment.

Cons:

- Increased Monthly Payment: Your monthly mortgage payment will be higher.

- Less Control: You rely on your lender to pay the taxes on time and you might not have immediate access to excess funds if your property taxes decrease.

- Escrow Account Adjustments: If your property taxes increase, you could face a higher mortgage payment or a lump sum due at the end of the year.

How to Determine If Your Mortgage Includes Property Taxes?

Knowing whether your mortgage includes property taxes is crucial for effective financial planning. Here’s how you can find out:

1. Review Your Mortgage Statement: Your monthly statement should have a clear breakdown of how your payment is being applied – look for line items labeled “Escrow” or “Taxes”.

2. Contact Your Lender: If you’re unsure, the most straightforward method is to contact your lender directly. They can confirm whether your payment includes taxes and if so, how much.

3. Understand Local Tax Laws: Familiarize yourself with local property tax laws. Knowing when taxes are due and how they’re calculated can give you insight into whether they’re likely included in your mortgage.

In summary, whether or not to include property taxes in your mortgage payments depends on various factors, including your financial discipline, the type of loan you have, and your lender’s requirements. It’s a decision that can have a significant impact on your monthly budget and financial planning as a homeowner. Understanding your options and responsibilities can empower you to make the best choice for your situation.

Want Expert Advice?

When considering a mortgage or navigating the complexities of homeownership, having an experienced, dependable, and knowledgeable guide is invaluable. Rob Sturms, a seasoned Denver Mortgage Broker with a deep-rooted connection to Colorado, offers just that. With his unique blend of local expertise, comprehensive industry knowledge, and a commitment to personalized, efficient service, Rob stands out as an ideal choice for anyone looking to embark on the journey of homeownership or property investment in the Denver area.

Learn more about Rob’s Mortgage Loans →

Get mortgage advice from a mortgage broker in Denver, Colorado →

About Rob Sturms

With over three decades of experience, Rob Sturms is a trusted name in Colorado’s mortgage industry. Since 1993, he has been guiding clients with honesty and expertise through various loan options, ensuring personalized solutions for each homeowner’s journey. As the founder of Rob’s Mortgage Loans, Rob’s commitment to transparency and tailored service makes him the go-to choice for reliable lending assistance.

Related articles

How Many People Can Be On A Mortgage

Conventional Loan Appraisal Requirements

How To Get Pre Approved For A Home Loan