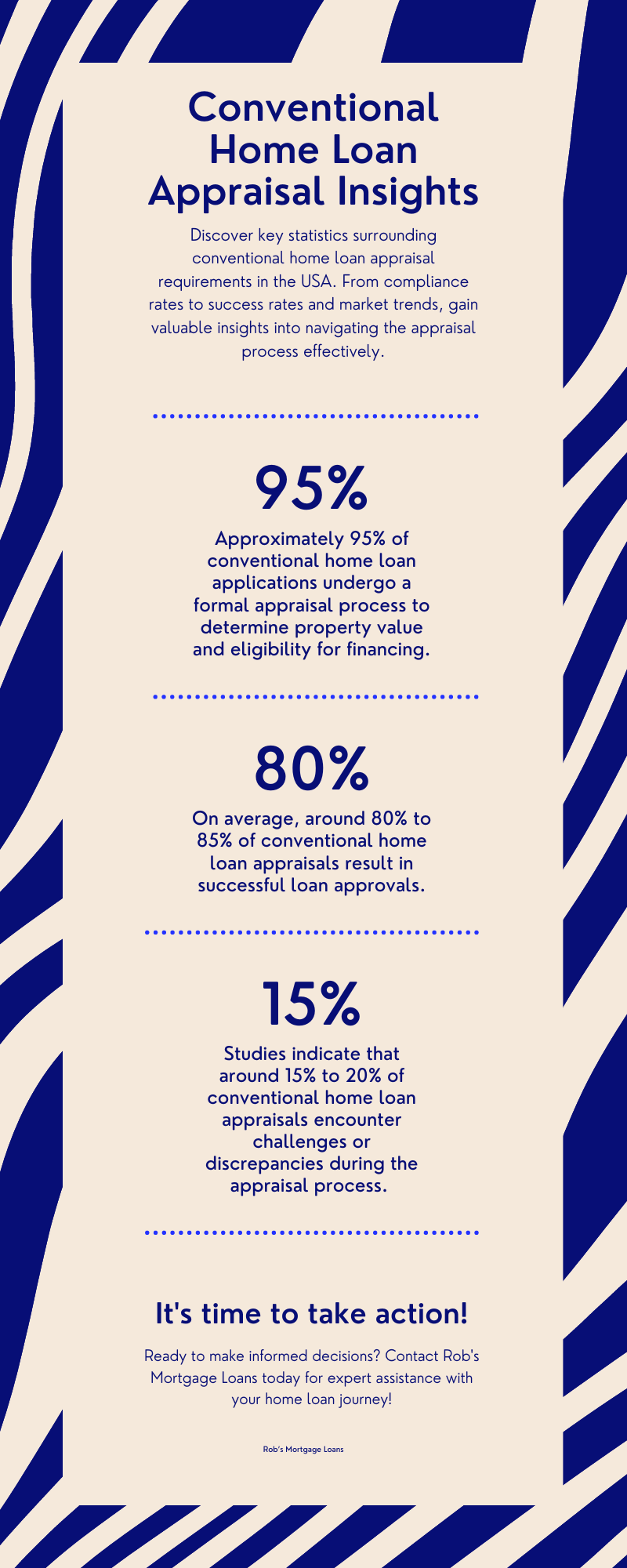

Understanding the intricacies of conventional loan appraisal requirements is essential in real estate financing. Appraisal requirements serve as a critical component in the process of securing a conventional loan, influencing the terms, eligibility, and overall success of the loan application.

At Rob’s Mortgage Loans, we recognize the significance of providing accurate and reliable information to our clients. With 3 decades of experience in the mortgage industry, we are committed to guiding borrowers through the complexities of conventional loan appraisal requirements, ensuring they navigate the process with confidence and clarity.

This article aims to provide a comprehensive overview of conventional loan appraisal requirements in 2024. From defining conventional loans and elucidating their significance in real estate transactions to delving into the intricacies of the appraisal process and its pivotal role in loan approval, we will cover a wide array of topics essential for borrowers seeking financing through conventional loans.

Understanding Conventional Loan Appraisal Requirements

Definition of conventional loans:

Conventional loans, often referred to as traditional mortgages, are loans that are not insured or guaranteed by the government. Private lenders offer them and typically require higher credit scores and larger down payments than government-backed loans such as FHA. Understanding the nuances of conventional loans is crucial for borrowers navigating the real estate market.

The Appraisal Process:

The appraisal process is a fundamental step in the conventional loan application process. It involves the assessment of the property’s value by a licensed appraiser to determine its market worth. Appraisals take into account various factors such as the property’s condition, location, comparable sales, and market trends. The appraisal report plays a pivotal role in determining the loan amount, interest rate, and terms offered by the lender.

- Engagement: The lender hires a licensed appraiser.

- Property Inspection: The appraiser visits the property to assess its condition.

- Market Analysis: The appraiser looks at similar properties in the area to gauge the property’s value.

- Data Collection: The appraiser gathers information about the property and its surroundings.

- Valuation: Using all the collected data, the appraiser determines the property’s value.

- Appraisal Report: The appraiser puts everything into a report and sends it to the lender.

- Review: The lender checks the report to make sure everything is in order.

- Decision: Based on the appraisal, the lender decides if the property meets their criteria for the loan.

- Notification: The borrower is informed about the outcome of the appraisal and its impact on the loan process.

Why it’s important to meet the requirements:

Meeting appraisal requirements is essential for borrowers seeking to secure a conventional loan. Lenders rely on appraisal reports to assess the risk associated with the loan and ensure that the property serves as adequate collateral for the loan amount. Failure to meet appraisal requirements can result in loan denial or adjustments to the loan terms, affecting the borrower’s ability to purchase or refinance a property.

The appraisal not only determines the loan eligibility but also influences the terms offered by the lender. A favorable appraisal, indicating that the property’s value aligns with the loan amount, can result in more favorable terms such as lower interest rates and reduced down payment requirements. Conversely, a low appraisal may necessitate a larger down payment or higher interest rate to mitigate the lender’s risk.

The Conventional Loan Appraisal Requirements

Single-family property considerations:

When appraising single-family properties for conventional loans, several factors come into play. These may include the property’s size, condition, location, and overall suitability for residential living. Appraisers assess the property’s layout, amenities, and any unique features that may affect its value. Additionally, the neighborhood and surrounding properties can influence the appraisal, as comparable sales in the area are used to determine the property’s market value. It’s essential for borrowers to ensure that their single-family property meets the lender’s standards and is in good condition to maximize its appraised value.

Sale price evaluation and its relation to appraisal requirements:

The sale price of a property is a critical aspect of the appraisal process. Appraisers compare the sale price of the property to similar sales in the area to determine its market value. If the sale price exceeds the property’s appraised value, it may signal inflated prices or potential appraisal challenges. Lenders may require additional documentation or justification for the sale price to ensure it aligns with the property’s value. Conversely, if the sale price is lower than expected, it could indicate a potential bargain for the buyer but may also raise questions about the property’s condition or market demand.

Overview of the Department of Housing and Urban Development (HUD) guidelines:

HUD guidelines play a significant role in the appraisal process for conventional loans, particularly regarding property condition and safety standards. Appraisers must adhere to HUD guidelines when assessing properties for FHA loans, but these standards may also influence conventional loan appraisals. HUD guidelines cover various aspects, including lead-based paint hazards, health and safety concerns, property maintenance, and structural integrity. Compliance with HUD guidelines is essential to ensure that the property meets minimum standards for habitability and safety.

Factors affecting the appraisal process:

Several factors can impact the appraisal process for conventional loans, including environmental hazards such as lead-based paint. Properties built before 1978 may contain lead-based paint, which poses health risks, particularly to children and pregnant women. Appraisers are required to identify and document any lead-based paint hazards and recommend appropriate remediation measures. Additionally, home inspections may uncover issues such as structural defects, plumbing problems, or safety hazards that could affect the property’s value and appraisal requirements.

Comparison with FHA loan requirements:

While conventional and FHA loans share similarities in appraisal requirements, there are notable differences between the two loan programs. FHA loans are insured by the Federal Housing Administration and have more stringent appraisal requirements compared to conventional loans.

FHA appraisals typically involve a more thorough inspection of the property, focusing on health and safety standards outlined in HUD guidelines. Additionally, FHA appraisers may require repairs or corrections to ensure the property meets FHA’s minimum property standards (MPS). These standards cover various aspects, including the condition of the roof, HVAC systems, electrical and plumbing systems, and overall structural integrity.

In contrast, conventional loan appraisals may be less stringent, focusing primarily on the property’s market value and condition. While lenders may still require repairs or improvements to address significant issues identified during the appraisal, the standards are generally less prescriptive compared to FHA loans. Borrowers opting for conventional loans may have more flexibility in negotiating repairs and modifications with the seller, as long as the property meets the lender’s appraisal requirements.

It’s essential for borrowers to understand the differences between conventional and FHA loan requirements when considering their financing options. While FHA loans may offer benefits such as lower down payments and more lenient credit requirements, they come with stricter appraisal standards and may require additional repairs or improvements to meet MPS. On the other hand, conventional loans may offer more flexibility and fewer appraisal requirements but typically require higher credit scores and larger down payments. By evaluating their specific needs and financial situation, borrowers can make informed decisions about the most suitable loan option for their home purchase or refinance.

Conventional Loan Appraisal Checklist for 2024

Checklist Covering All Essential Components of The Conventional Loan Appraisal Requirements:

- Property Condition:

-

-

- Inspect the property thoroughly for any signs of wear and tear, damage, or deterioration.

- Check the exterior, including the roof, siding, foundation, and landscaping, for any visible issues.

- Assess the interior for any structural concerns, such as cracks in walls or ceilings, uneven floors, or water damage.

- Evaluate the condition of major systems and components, including HVAC, plumbing, electrical, and appliances.

- Address any significant defects or safety hazards that could impact the property’s value or habitability.

-

- Property Documentation:

-

-

- Collect all relevant documentation related to the property, including ownership records, title documents, and property surveys.

- Provide documentation for any recent renovations, upgrades, or improvements made to the property.

- Include permits and approvals obtained for any construction or renovation work completed on the property.

- Disclose any known issues or defects to the appraiser, including past repairs or maintenance issues.

-

- Comparable Sales Analysis:

-

-

- Research recent sales of comparable properties in the neighborhood or local market.

- Identify properties with similar characteristics, including size, age, condition, and amenities.

- Gather information on comparable sales, including sale prices, square footage, number of bedrooms and bathrooms, and lot size.

- Consider factors such as location, school district, and neighborhood amenities when selecting comparable properties.

- Highlight any unique features or upgrades that differentiate the subject property from comparable sales.

-

- Environmental Considerations:

-

-

- Conduct a thorough inspection for any environmental hazards, including lead-based paint, asbestos, mold, or radon.

- Obtain testing and assessment reports for environmental hazards, if applicable.

- Provide documentation of any remediation or mitigation measures taken to address environmental concerns.

- Ensure compliance with local regulations and disclosure requirements regarding environmental hazards.

-

- Accessibility and Safety:

-

-

- Evaluate the property for compliance with accessibility standards, including ADA requirements for ramps, handrails, and doorways.

- Check for any safety hazards, such as trip hazards, electrical issues, or fire hazards.

- Address any deficiencies in accessibility or safety to ensure the property is suitable for occupancy.

- Consider factors such as proximity to emergency services, schools, and public transportation when assessing safety and accessibility.

-

- Market Analysis:

-

- Conduct a comprehensive analysis of the local real estate market, including trends in property values, supply and demand, and market conditions.

- Consider economic factors, employment trends, and demographic changes that may impact property values.

- Consult with local real estate professionals or appraisers for insights into market conditions and trends.

- Adjust the property’s valuation based on market factors and comparable sales data to ensure accuracy and relevance.

Step-by-Step Guide to Ensure Compliance with 2024’s Conventional Loan Appraisal Requirements:

- Pre-Appraisal Preparation:

-

-

- Schedule a thorough inspection of the property to identify any issues or concerns.

- Gather all necessary documentation, including property records, permits, and renovation history.

- Address any visible defects or maintenance issues to ensure the property presents well during the appraisal.

-

- Communication with the Appraiser:

-

-

- Provide the appraiser with relevant information about the property, including recent upgrades or improvements.

- Be transparent about any known issues or concerns that may affect the property’s value.

- Answer any questions the appraiser may have about the property to facilitate an accurate assessment.

-

- Review of Appraisal Report:

-

- Review the appraisal report carefully to ensure all relevant information is accurate and complete.

- Verify that the appraiser has considered all relevant factors, including property condition, comparable sales, and market trends.

- Address any discrepancies or concerns with the appraiser or lender to ensure the accuracy of the appraisal.

Importance of Thorough Preparation for the Appraisal Process:

- Thorough preparation plays a pivotal role in maximizing the property’s appraised value and expediting the loan process. By diligently addressing maintenance issues and making necessary repairs or improvements, borrowers can significantly enhance the property’s appeal to both appraisers and potential buyers.

- This not only increases the likelihood of receiving a favorable appraisal but also boosts the property’s marketability and overall value. Moreover, a well-prepared property appraisal can expedite the loan approval process by providing lenders with accurate and reliable information.

- By proactively addressing potential appraisal challenges upfront, borrowers can avoid delays and streamline the loan approval process, ensuring a smoother and more efficient transaction.

Tips for Addressing Potential Appraisal Discrepancies:

- Provide supporting documentation for any upgrades or improvements made to the property.

- Highlight the property’s unique features and amenities that may not be immediately apparent to the appraiser.

- Address any potential appraisal challenges or discrepancies proactively to avoid last-minute surprises.

- Work closely with the appraiser and lender to resolve any issues or concerns that may arise during the appraisal process.

- Stay informed about current market trends and comparable sales in the area to provide context for the property’s valuation.

- Be prepared to advocate for the property’s value by providing relevant market data and information to the appraiser.

Ensuring Smooth Loan Processing with Appraisal Compliance

Benefits of Adhering to Conventional Loan Appraisal Requirements:

Adhering to conventional loan appraisal requirements offers several benefits for borrowers. Firstly, it ensures that the property’s value aligns with the loan amount, reducing the risk of overvaluing or undervaluing the property. This, in turn, enhances the lender’s confidence in the loan’s collateral and may result in more favorable loan terms for the borrower, such as lower interest rates or down payment requirements. Additionally, compliance with appraisal requirements fosters transparency and trust in the lending process, providing borrowers with peace of mind and minimizing the likelihood of disputes or challenges down the line.

Consequences of Failing to Meet The Conventional Loan Appraisal Requirements:

Failing to meet appraisal standards can have significant consequences for borrowers. If the property appraises lower than expected or fails to meet the lender’s appraisal requirements, it may lead to loan denial or delays in loan processing. This can disrupt the home buying or refinancing process, causing frustration and financial strain for the borrower. Moreover, discrepancies or challenges in the appraisal process can result in increased costs, such as additional appraisal fees or repair expenses to address appraisal-related issues. Ultimately, failing to meet appraisal standards can jeopardize the borrower’s ability to secure financing and achieve their homeownership goals.

Importance of Working with Experienced Professionals During the Appraisal Process:

Working with experienced professionals, including real estate agents, appraisers, and mortgage brokers, is crucial during the appraisal process. Experienced professionals can provide valuable insights and guidance to borrowers, helping them navigate the complexities of the appraisal process and address any challenges or concerns that may arise. Moreover, seasoned professionals have in-depth knowledge of local market conditions and appraisal standards, enabling them to advocate effectively for the property’s value and negotiate favorable outcomes on behalf of the borrower. By partnering with experienced professionals, borrowers can streamline the appraisal process and increase their chances of securing a successful loan approval.

Recap of Key Points Covered in the Article:

Throughout this article, we’ve explored the essential components of conventional loan appraisal requirements and highlighted the importance of thorough preparation and compliance with these standards. We’ve discussed the benefits of adhering to appraisal requirements, the consequences of failing to meet these standards, and the significance of working with experienced professionals during the appraisal process.

Further Assistance for Your Conventional Home Loan Journey:

If you have any questions or need assistance with your mortgage financing needs, don’t hesitate to reach out to Rob’s Mortgage Loans. Our team of experienced professionals is here to help you navigate the appraisal process and secure the financing solution that best fits your needs.

Finally, we emphasize the importance of staying informed about industry updates and regulatory changes that may impact the appraisal process and mortgage lending landscape. By staying informed and proactive, borrowers can adapt to changes in the market and regulatory environment, ensuring a smooth and successful homeownership journey.

With over three decades of experience, Rob Sturms is a trusted name in Colorado’s mortgage industry. Since 1993, he’s been guiding clients with honesty and expertise through various loan options, ensuring personalized solutions for each homeowner’s journey. As the founder of Rob’s Mortgage Loans, Rob’s commitment to transparency and tailored service makes him the go-to choice for reliable lending assistance.

Looking for a Denver Mortgage Broker? Contact Rob today to get started!