The question on many homeowners’ minds; Can you get an FHA loan twice? The answer is yes, but there are important criteria and stipulations to understand. In this blog post, we’ll dive deep into the possibilities and limitations of securing a second FHA loan.

FHA loans, insured by the Federal Housing Administration, are popular among first-time homebuyers due to their lower down payment requirements and more lenient credit qualifications compared to conventional loans. However, their appeal isn’t limited to just first-time buyers.

This guide aims to provide you with a comprehensive understanding of what it takes to qualify for an FHA loan a second time around. Whether you’re relocating, upsizing, or simply exploring your options, this article will be your roadmap to navigating the complexities of FHA loans for repeat borrowers.

Table of contents

- Can you get an FHA loan twice?

- What are the requirements for a second FHA loan?

- What is the application process of getting a second FHA loan?

- Are there any additional costs with an FHA loan?

- What are some potential problems with getting a second FHA loan?

- Are there any alternatives to getting a second FHA loan?

- Some expert tips for getting a second FHA loan

- So can you get an FHA loan twice?

- Frequently Asked Questions

- How can I begin the process of getting my second FHA loan today?

Can you get an FHA loan twice?

To qualify for a second FHA loan, certain conditions must be met. Firstly, FHA loans are primarily meant for primary residences. If you’re thinking of purchasing a second home or an investment property, an FHA loan isn’t the right tool for that purpose. Your new FHA loan must be for a house you plan to live in.

There are special circumstances where obtaining another FHA loan becomes feasible. For instance, if you’re relocating for a job that’s a significant distance from your current primary residence, you might qualify. Similarly, if your family size has increased since your first FHA loan and you need a larger home, this can also be a valid reason. Each of these situations is reviewed on a case-by-case basis, emphasizing the necessity of the move.

The insistence on the FHA loan being for a primary residence can’t be overstated. FHA loans are not designed for real estate investors; they are meant to help individuals and families become homeowners. This means you must move into the new home financed by the FHA loan within a reasonable time frame, typically 60 days after closing.

What are the requirements for a second FHA loan?

To qualify for a second FHA loan, you must meet certain requirements:

- Maintain a credit score of at least 580 for more favorable down payment options.

- Keep your debt-to-income ratio below 43%.

- Ensure your existing FHA loan is in good standing, with a history of timely payments.

- Potentially hold a significant equity position in your current home, or consider selling it.

- Adhere to waiting periods following financial setbacks, such as two years post-Chapter 7 bankruptcy discharge and three years after foreclosure, though these may vary based on individual circumstances.

- The home financed by the second FHA loan must be your primary residence. FHA loans are not designed for investment or vacation properties.

- You must demonstrate that you have sufficient and stable income to cover both your current financial obligations and the potential new mortgage.

- If you currently have an FHA loan, you need a compelling reason for a second one. This could include relocating for work (to a different area) or needing a larger home due to family growth.

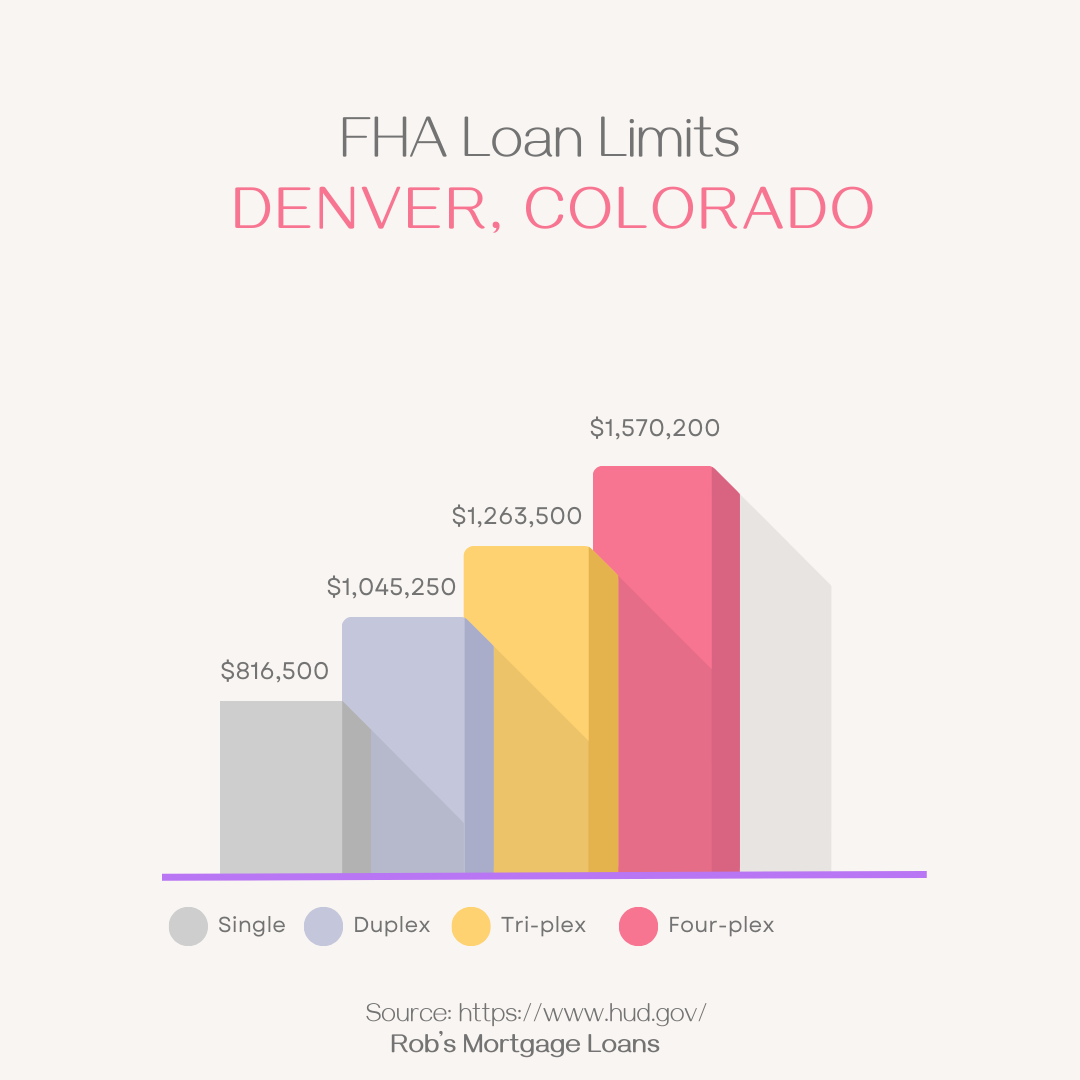

- The amount you’re borrowing with the second FHA loan must be within the FHA loan limits for the area where the property is located.

- Be prepared to pay for mortgage insurance, which includes an upfront premium and an annual premium.

What is the application process of getting a second FHA loan?

Applying for a second FHA loan isn’t markedly different from your first application, but there are key steps and requirements you need to be aware of.

- Assess Financial Readiness: Start by checking your credit score and calculating your debt-to-income ratio. Review your budget to ensure you can handle the additional mortgage responsibility.

- Choose an FHA-Approved Lender: Approach a bank, credit union, or financial institution authorized to issue FHA loans. Select a lender based on favorable terms and good customer service.

- Complete the Loan Application: Fill out the necessary forms provided by the lender. This will include personal information, financial details, and information about your current mortgage and the property you wish to purchase.

- Submit Required Documentation: Provide all the required documentation, such as proof of income, bank statements, employment verification, and any other documents requested by the lender to support your application.

Are there any additional costs with an FHA loan?

FHA loan limits vary depending on the county and the type of property. These limits are periodically updated, reflecting changes in the housing market. It’s important to know the loan limits in your area to ensure the property you’re interested in falls within these boundaries.

What are some potential problems with getting a second FHA loan?

As a repeat borrower, there are unique challenges and considerations to keep in mind.

Evaluate your financial readiness for another mortgage. Consider current debts, your ability to afford a second home, and the impact of additional mortgage insurance premiums.

Multiple FHA loans mean more financial commitments. It’s crucial to assess how a second mortgage will affect your budget, savings, and long-term financial plans.

If the loan limit, mortgage insurance cost, or other FHA loan aspects don’t align with your needs, it may be time to explore other options.

Are there any alternatives to getting a second FHA loan?

Several other mortgage options might suit your situation better than an FHA loan.

Consider conventional loans, which might offer more flexible terms and higher loan limits. VA loans (for veterans and service members) or USDA loans (for rural properties) are also worth exploring.

Each loan type comes with its advantages and disadvantages. Conventional loans often require higher credit scores and larger down payments, but they don’t mandate mortgage insurance if you have 20% equity.

If you have a strong credit score and sufficient down payment, a conventional loan might be more economical. Similarly, if you’re a veteran, a VA loan could offer better terms than an FHA loan.

Understanding these aspects ensures that you’re well-prepared for your journey towards securing a second FHA loan or choosing an alternative that better fits your needs.

Some expert tips for getting a second FHA loan

Navigating the complexities of obtaining a second FHA loan requires sound financial planning and awareness of potential pitfalls.

Financial Planning and Management Tips

Start by creating a comprehensive budget that accounts for your existing mortgage (if applicable), potential new mortgage payments, insurance, and property maintenance costs. It’s also crucial to build and maintain an emergency fund, ideally covering six months of living expenses, to safeguard against unforeseen financial challenges.

Common Pitfalls to Avoid

Overlooking additional costs such as closing fees, property taxes, and homeowners association fees is a common mistake. Another pitfall is neglecting to consider how a change in your employment or income could impact your ability to manage two mortgages. Always plan for the long term, considering potential changes in your financial circumstances.

Insights from Mortgage Professionals

Mortgage experts advise that borrowers should thoroughly understand the terms and conditions of their new FHA loan. They also emphasize the importance of maintaining a good credit score and a low debt-to-income ratio. Engage with a mortgage advisor early in the process to explore your options and understand the full implications of taking on a second FHA loan.

So can you get an FHA loan twice?

In conclusion, obtaining a second FHA loan is a feasible option for many, but it requires careful consideration and planning. We’ve explored the application process, the intricacies of FHA loan limits and mortgage insurance, and the challenges you might face as a repeat borrower.

Remember, informed decision-making is key in any significant financial endeavor. Don’t hesitate to seek advice from financial and mortgage professionals to fully understand your options and obligations. FHA loans offer a valuable opportunity for homeownership, but they also carry responsibilities that you should be fully prepared for.

Frequently Asked Questions

Q: Can I have two FHA loans at the same time?

A: Generally, you cannot have two FHA loans simultaneously. Exceptions are made for specific situations, such as relocating for work or needing a larger home due to family growth.

Q: What are the credit requirements for a second FHA loan?

A: The credit requirements remain similar to those for your first FHA loan. A credit score of at least 580 is typically required for the most favorable down payment options.

Q: How does an FHA loan affect my taxes?

A: FHA loan interest payments are generally tax-deductible, similar to other mortgage types. However, it’s advisable to consult with a tax professional for specific advice regarding your situation.

Through understanding and preparation, repeat FHA borrowers can successfully navigate the path to securing their second FHA loan, aligning their homeownership goals with their financial capabilities and future plans.

How can I begin the process of getting my second FHA loan today?

Remember that getting a FHA loan twice is a feasible option for many veterans, though it requires careful planning and understanding of the rules and limitations. At Rob’s Mortgage Loans, we are committed to helping home owners like you navigate this process with ease.

For personalized advice and assistance, don’t hesitate to contact us. We encourage you to sign up for our newsletter or schedule a consultation to stay updated and informed about FHA loans.

Book a free second FHA loan consultation >

Read more about our FHA loan services >

About Robert Sturms

With over three decades of experience, Rob Sturms is a trusted name in Colorado’s mortgage industry. Since 1993, he has been guiding clients with honesty and expertise through various loan options, ensuring personalized solutions for each homeowner’s journey. As the founder of Rob’s Mortgage Loans, Rob’s commitment to transparency and tailored service makes him the go-to choice for reliable lending assistance.