Why You Need To Understand FHA Loan Limits in Denver, Colorado

In Denver, Colorado, understanding FHA loan limits is crucial for prospective homebuyers and homeowners alike. FHA loan limits dictate the maximum amount borrowers can receive through an FHA loan in a particular area. Since Denver has a dynamic real estate market with fluctuating property values, being aware of these limits ensures that borrowers can accurately gauge their purchasing power and make informed decisions when buying or refinancing a home.

The purpose of this blog post is to provide comprehensive information about FHA loan limits in Denver, Colorado for the year 2024. By delving into the intricacies of FHA loan limits, we aim to equip readers with the knowledge they need to navigate the local housing market successfully. From understanding the factors influencing these limits to the significance of adhering to them, our goal is to empower readers to make informed choices when it comes to their home financing options.

What are FHA loans?

Federal Housing Administration (FHA) loans are a type of government-backed mortgage designed to help individuals with lower credit scores or limited down payment funds to become homeowners. These loans are insured by the FHA, which means that lenders are protected in case borrowers default on their payments. FHA loans typically offer more flexible qualification requirements compared to conventional loans, making them accessible to a broader range of borrowers.

The FHA Loan Limits in Denver, Colorado for 2024

FHA Loan Limits Specific to Denver for 2024

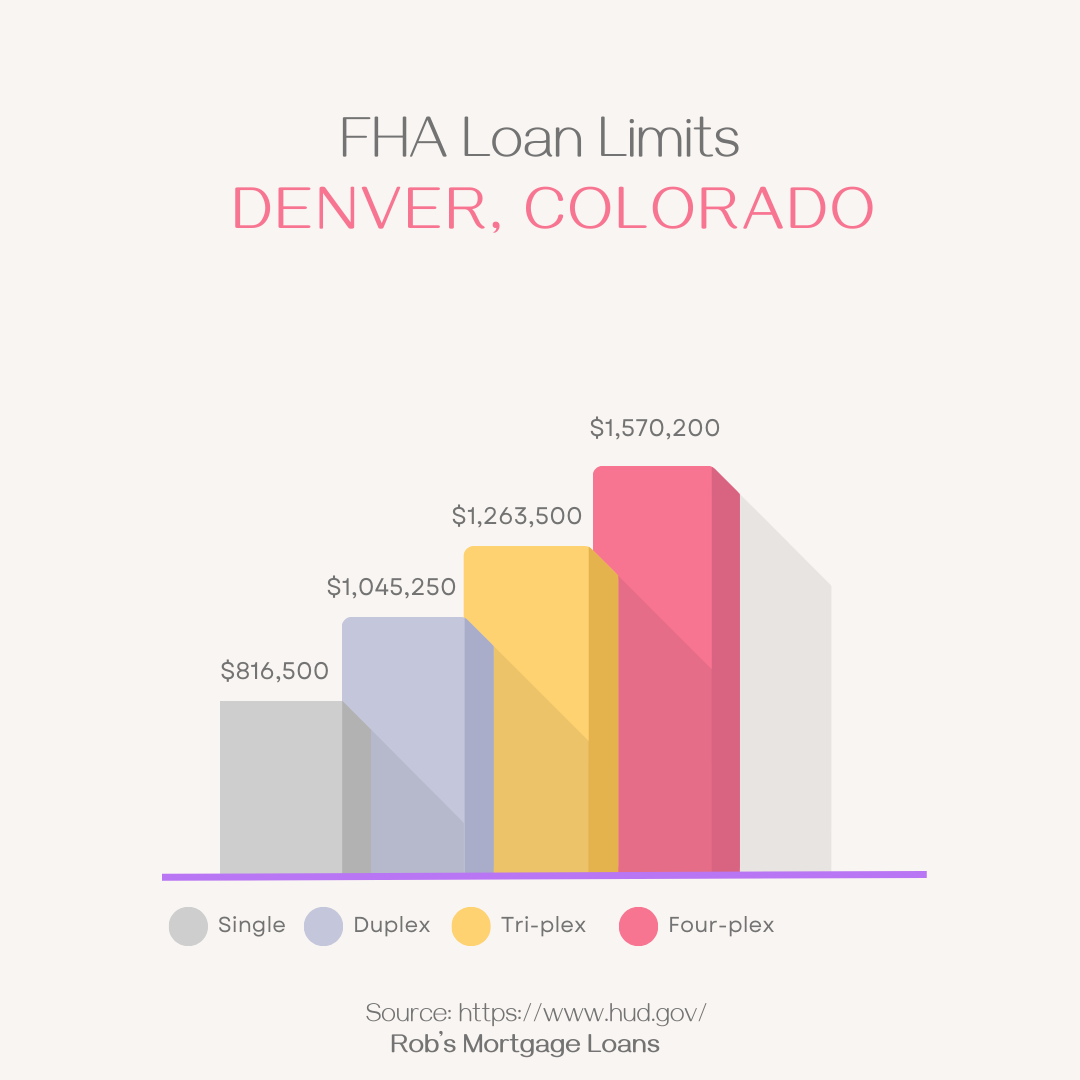

In 2024, FHA loan limits in Denver reflect the ongoing trend of rising home prices, impacting the accessibility of homeownership for many prospective buyers. The Federal Housing Administration‘s recent announcement outlines these limits, emphasizing their importance in facilitating affordable financing options amidst escalating property values.

For single-family homes, the FHA loan limit for Denver Metro including Lakewood, Littleton, Englewood, Aurora, Lonetree, Parker, Golden, Wheat Ridge, etc aligns with the national trend, with a maximum of $816,500. This figure extends to $1,045,250 for duplexes, $1,263,500 for triplexes, and $1,570,200 for four-plex properties.

These limits are crucial as they dictate the maximum amount borrowers can secure through FHA-insured mortgages, catering to varying property types and accommodating the diverse needs of Denver’s housing market. As Denver continues to experience robust growth and demand, these loan limits play a pivotal role in ensuring continued access to affordable housing options for residents across the city.

Impact of Economic Factors on the 2024 Limits

Several economic factors influence the establishment of FHA loan limits for Denver, Colorado, in 2024. These include local housing market conditions, employment trends, inflation rates, and interest rate movements. A robust economy typically correlates with higher property values, which can lead to an increase in FHA loan limits to accommodate the rising cost of housing. Conversely, economic downturns or stagnation may result in more conservative loan limits to mitigate risk. By staying informed about these economic indicators, borrowers can better understand the rationale behind the 2024 FHA loan limits and adapt their home financing strategies accordingly.

How FHA Loan Limits Affect Borrowers in Denver

FHA loan limits directly impact borrowers in Denver by determining the maximum amount of financing they can receive through an FHA loan. For borrowers seeking to purchase a home, these limits dictate the price range of properties they can consider and influence their down payment requirements. Similarly, homeowners looking to refinance their existing FHA loans must ensure they stay within the applicable loan limits to qualify for refinancing options. Understanding how these limits affect their purchasing power is essential for borrowers to make informed decisions in Denver’s competitive housing market.

Strategies for Navigating Within These Limits

Navigating within FHA loan limits in Denver requires careful planning and strategic decision-making. Borrowers can explore various strategies to optimize their home buying or refinancing experience, such as:

- Researching affordable neighborhoods within the FHA loan limit range.

- Considering properties that may require renovation or rehabilitation, as FHA 203(k) loans allow borrowers to finance both the purchase price and renovation costs within the loan limit.

- Saving for a larger down payment to bridge the gap between the purchase price and FHA loan limit, thereby reducing the loan amount and associated costs.

- Exploring alternative loan options if the desired property exceeds the FHA loan limit, such as conventional loans or down payment assistance programs.

By employing these strategies, borrowers can maximize their opportunities within the FHA loan limits while achieving their homeownership goals in Denver.

The Importance of Consulting With a Mortgage Advisor

Given the complexities of navigating FHA loan limits and the intricacies of the home financing process, consulting with a knowledgeable mortgage advisor is paramount for borrowers in Denver. A qualified advisor can provide personalized guidance tailored to individual financial situations and housing needs. They can offer insights into available loan options, eligibility requirements, and potential strategies for optimizing financing within FHA loan limits. Additionally, mortgage advisors can help borrowers navigate the loan application and approval process, ensuring a smooth and efficient experience from start to finish. By leveraging the expertise of a mortgage advisor, borrowers can make well-informed decisions that align with their long-term financial objectives and homeownership aspirations in Denver.

Implications for the Housing Market

Potential Effects of FHA Loan Limits on the Denver Housing Market

The FHA loan limits play a significant role in shaping the dynamics of the Denver housing market. These limits directly impact the affordability of homes for potential buyers, particularly first-time homebuyers or those with limited down payment funds. When FHA loan limits increase, it can stimulate demand by expanding the pool of eligible buyers and potentially driving up home prices in certain segments of the market. Conversely, if FHA loan limits remain stagnant or decrease, it may restrict purchasing power and lead to a slowdown in home sales, particularly in higher-priced neighborhoods. Additionally, FHA loan limits can influence the availability of financing options for borrowers, affecting the overall liquidity and activity within the housing market.

Predictions for Homebuyers and Sellers

For homebuyers in Denver, fluctuations in FHA loan limits can present both opportunities and challenges. Higher FHA loan limits may open up access to a broader range of properties and increase competition among buyers, potentially driving up prices in certain neighborhoods. Conversely, lower loan limits may necessitate more conservative purchasing decisions and could lead to more negotiation power for buyers in certain transactions. Sellers, on the other hand, may need to adjust their pricing strategies and expectations based on prevailing FHA loan limits and buyer demand. Monitoring these limits and understanding their implications is essential for both buyers and sellers to make informed decisions in Denver’s dynamic housing market.

Analysis of Market Trends and Their Correlation with FHA Loan Limits

Analyzing market trends alongside FHA loan limits provides valuable insights into the broader economic forces shaping the Denver housing market. Factors such as employment growth, population trends, interest rates, and housing inventory levels all interact with FHA loan limits to influence market dynamics. By examining historical data and market indicators, analysts can identify correlations between changes in FHA loan limits and corresponding shifts in home prices, sales volume, and market activity. This analysis helps stakeholders, including lenders, real estate professionals, and policymakers, anticipate market trends and formulate strategies to adapt to changing conditions effectively.

Tips for Maximizing FHA Loan Benefits

How to Leverage FHA Loans Effectively in Denver’s Real Estate Market

Leveraging FHA loans effectively in Denver’s real estate market requires a comprehensive understanding of local market conditions, FHA loan eligibility criteria, and available financing options. Prospective buyers can benefit from working with experienced real estate agents who specialize in FHA transactions and can help identify properties that align with FHA loan requirements. Additionally, buyers should prioritize pre-approval for FHA financing to demonstrate their eligibility and strengthen their offers in competitive markets.

Optimizing Financial Strategies Within the Loan Limits

Optimizing financial strategies within FHA loan limits involves carefully assessing one’s budget, savings, and long-term financial goals. Buyers should aim to maximize their down payment funds to minimize their loan amounts and associated costs, such as mortgage insurance premiums. Exploring down payment assistance programs and FHA-approved lenders offering competitive interest rates can also help borrowers secure favorable financing terms within the loan limits.

Advice for Prospective Homebuyers Seeking FHA Loans

Prospective homebuyers seeking FHA loans should prioritize thorough research and due diligence to navigate the complexities of the home buying process successfully. It’s essential to familiarize oneself with FHA loan requirements, including credit score thresholds, debt-to-income ratios, and property appraisal guidelines. Working closely with a trusted mortgage advisor can provide invaluable guidance and support throughout the home buying journey, from loan pre-approval to closing. By staying informed, proactive, and strategic, prospective homebuyers can maximize the benefits of FHA loans and achieve their homeownership dreams in Denver’s competitive real estate market.

How To Informed About FHA Loan Regulations

Staying informed about FHA loan regulations is essential for borrowers, lenders, and other stakeholders in the Denver real estate market. To stay up-to-date on the latest FHA loan regulations and policy changes, individuals can utilize various resources, including:

- Official FHA website: The U.S. Department of Housing and Urban Development (HUD) website provides comprehensive information on FHA loan programs, guidelines, and updates.

- Mortgage industry publications: Industry publications and trade journals often cover regulatory changes and updates affecting FHA loans and other mortgage products.

- Mortgage lenders and advisors: Working with knowledgeable mortgage lenders and advisors who specialize in FHA financing can provide valuable insights and guidance on regulatory changes and their implications.

- Local housing agencies: Local housing agencies in Denver may offer resources, workshops, and educational materials on FHA loan programs and regulations.

- HUD-approved housing counseling agencies: HUD-approved housing counseling agencies can provide free or low-cost counseling services to borrowers seeking information and assistance with FHA loans and homeownership.

DHA Loan Limits in Denver

Throughout this blog post, we’ve explored the significance of FHA loan limits in Denver, Colorado, for the year 2024. We’ve discussed how these limits impact borrowers, sellers, and the overall housing market, as well as strategies for maximizing FHA loan benefits and navigating within the loan limits.

Understanding and adhering to FHA loan limits is crucial for prospective homebuyers and homeowners in Denver to make informed decisions and effectively navigate the local housing market. By staying informed about FHA loan regulations and guidelines, borrowers can maximize their opportunities for homeownership while minimizing risks and challenges.

Begin Your FHA Loan Journey Today

With over three decades of experience, Rob Sturms is a trusted name in Colorado’s mortgage industry. Since 1993, he’s been guiding clients with honesty and expertise through various loan options, ensuring personalized solutions for each homeowner’s journey. As the founder of Rob’s Mortgage Loans, Rob’s commitment to transparency and tailored service makes him the go-to choice for reliable lending assistance.

Ready to secure your dream home? Contact Rob today to get started!