Understanding VA Loan Assumability

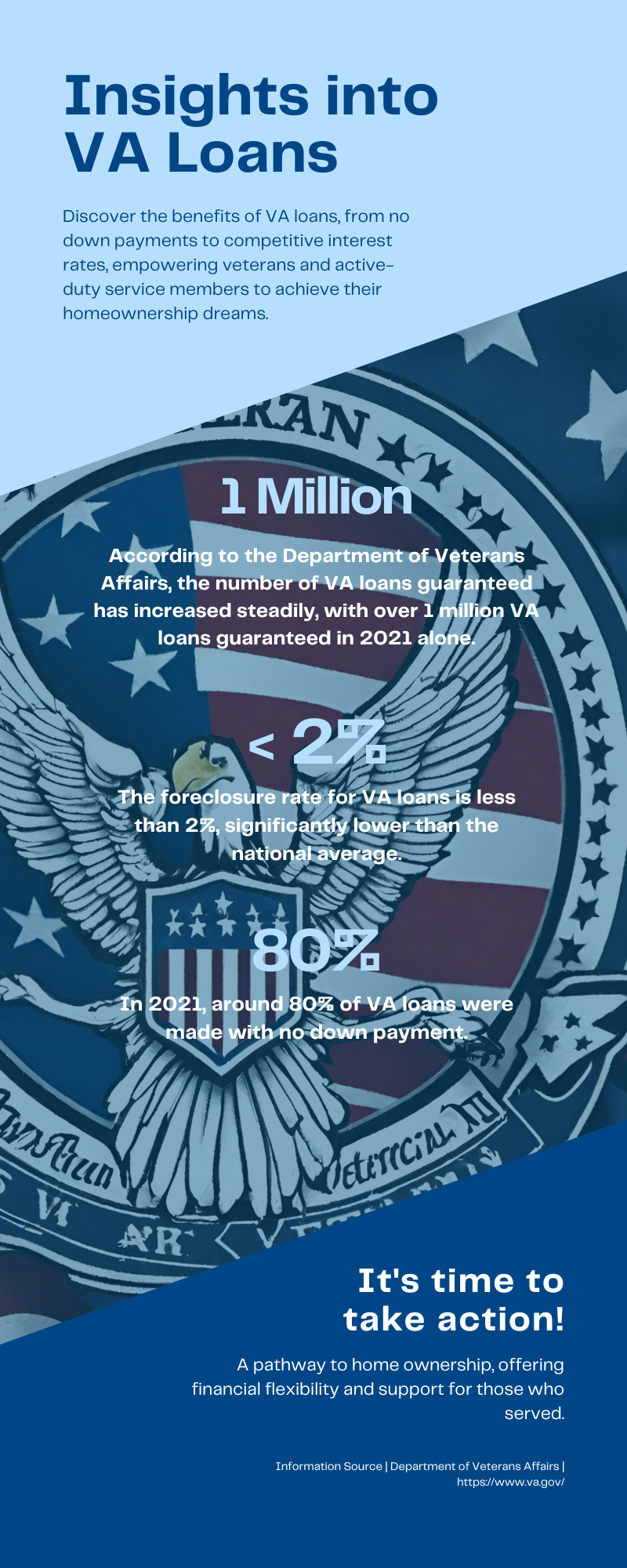

In the real estate financing landscape, one key aspect often flies under the radar: are VA loans assumable? As veterans, active-duty service members, and eligible surviving spouses navigate the path to homeownership, understanding the nuances of VA loan assumability can pave the way for greater flexibility and financial advantage.

In this comprehensive guide, we delve into the intricacies of VA loans, shedding light on their unique features and the often overlooked opportunity they present for both buyers and sellers. From defining assumable loans to unraveling the advantages and potential drawbacks, we equip readers with the knowledge needed to navigate this aspect of the real estate market with confidence.

Explanation of VA Loans:

VA loans are mortgage loans provided by mortgage lenders but guaranteed by the U.S. Department of Veterans Affairs (VA). These loans are specifically designed to help active-duty service members, veterans, and eligible surviving spouses become homeowners. VA loans offer several unique advantages, including competitive interest rates, no down payment requirement (in most cases), and reduced closing costs. One of the lesser-known aspects of VA loans is their assumability, which allows qualified individuals to take over the existing VA loan from the current borrower.

Definition of Assumable Loans:

An assumable loan is a type of mortgage that allows a buyer to take over the seller’s existing mortgage loan. In other words, the buyer assumes responsibility for the outstanding balance, repayment terms, and interest rate of the seller’s loan. This can be an attractive option for buyers, especially if the current interest rate is lower than prevailing market rates.

Importance of Understanding Loan Assumability:

Understanding the concept of loan assumability, particularly within the context of VA loans, is crucial for both buyers and sellers in the real estate market. For buyers, knowing whether a VA loan is assumable can open up additional financing options and potentially save money on closing costs. For sellers, the ability to transfer their VA loan to a qualified buyer could make their property more appealing and facilitate a smoother sales process. Therefore, having a clear understanding of VA loan assumability can be advantageous for all parties involved in a real estate transaction.

What are VA Loans?

Overview of VA Loans:

VA loans are a valuable benefit offered to those who have served or are currently serving in the U.S. military. These loans are provided by mortgage lenders, such as banks and non bank mortgage companies, but they are guaranteed by the VA, which means that lenders are protected against loss if the borrower defaults on the loan. VA loans typically have more lenient eligibility requirements compared to conventional loans, making them accessible to a broader range of borrowers.

Benefits of VA Loans for Veterans and Active Duty Military:

VA loans offer numerous benefits to eligible borrowers, including:

- No down payment requirement (in most cases), making homeownership more accessible.

- Competitive interest rates that are often lower than those offered by conventional loans.

- No private mortgage insurance (PMI) requirement, resulting in lower monthly payments.

- Flexible credit requirements, allowing individuals with less-than-perfect credit to qualify.

- Assistance for eligible veterans who may be struggling with financial hardship, such as foreclosure avoidance programs.

Key Features of VA Loans:

Some key features of VA loans include:

VA loan limits, which vary depending on the location of the property and whether it’s a single-family home, condo, or multi-unit property.

Funding fee, which is a one-time fee paid to the VA at the time of closing. This fee helps offset the cost of the VA loan program and can be financed into the loan amount.

VA appraisal process, which ensures that the property meets minimum standards for safety, habitability, and value.

VA loan entitlement, which determines the maximum amount that the VA will guarantee for each eligible borrower.

Understanding these features can help borrowers make informed decisions when considering a VA loan for their home purchase.

Understanding Assumable Loans

Definition and Concept of Assumable Loans:

Assumable loans are mortgage loans that allow a buyer to take over the existing mortgage of the seller. In essence, the buyer assumes responsibility for the remaining balance, terms, and conditions of the seller’s loan. This arrangement can provide benefits to both parties involved in the transaction. For the buyer, assuming an existing loan can mean access to favorable terms, such as a lower interest rate or reduced closing costs. For the seller, it can make their property more attractive to potential buyers and potentially streamline the selling process.

Advantages and Disadvantages of Assumable Loans:

Advantages:

- Potential for lower interest rates: If the interest rate on the assumed loan is lower than current market rates, the buyer can benefit from lower monthly mortgage payments.

- Reduced closing costs: Since the loan is already in place, the buyer may avoid some of the typical closing costs associated with obtaining a new mortgage.

- Faster closing process: Assuming a loan can expedite the homebuying process since there is no need to go through the loan approval process again.

Disadvantages:

- Limited loan options: Not all mortgages are assumable, so buyers may have fewer options available to them.

- Transferability restrictions: Some loans may have restrictions on who can assume them or under what conditions, limiting the pool of potential buyers.

- Potential for higher interest rates: If the interest rate on the assumed loan is higher than current market rates, the buyer may end up paying more in interest over the life of the loan.

How Assumability Affects Borrowers and Sellers:

For Borrowers:

Access to favorable terms: Assumable loans can provide borrowers with access to lower interest rates and reduced closing costs, potentially saving them money over the long term.

Simplified process: Assuming a loan can streamline the homebuying process and reduce the time and paperwork involved in securing financing.

For Sellers:

Increased marketability: Offering an assumable loan can make a property more attractive to potential buyers, potentially leading to a quicker sale.

Potential for better terms: Sellers may be able to negotiate a higher sales price or other favorable terms by offering an assumable loan as an incentive.

Are VA Loans Assumable?

Explanation of VA Loan Assumption:

Yes, VA loans are assumable under certain conditions. This means that a qualified buyer can take over the seller’s existing VA loan, assuming responsibility for the remaining balance and terms of the loan.

Guidelines and Regulations Surrounding VA Loan Assumptions:

- The buyer must be creditworthy under the VA’s eligibility requirements.

- The seller must obtain approval from their lender and the VA to transfer the loan to the buyer.

- A new Certificate of Eligibility (COE) may be required for the assuming borrower.

Restrictions and Eligibility Criteria for Assuming a VA Loan:

- The assuming borrower must release liability of the VA – guaranteed loan. An assumption may be processed with or without a substitution of entitlement.

- The assuming borrower must meet the lender’s credit and income requirements.

- The assuming borrower may be required to pay a funding fee unless exempt due to certain qualifying factors.

Understanding these guidelines and eligibility criteria is essential for both buyers and sellers considering a VA loan assumption. It’s important to consult with a knowledgeable mortgage professional to determine if a VA loan assumption is the right option for your specific situation.

Pros and Cons of Assuming a VA Loan

Advantages for Buyers:

Lower interest rates: If the current interest rate on the assumed VA loan is lower than prevailing market rates, the buyer can benefit from reduced monthly mortgage payments and overall savings on interest costs.

No down payment requirement: VA loans typically do not require a down payment, making homeownership more accessible for buyers assuming a VA loan.

Reduced closing costs: Since the loan is already in place, buyers may avoid certain closing costs associated with obtaining a new mortgage, such as appraisal fees or origination charges.

Faster closing process: Assuming a VA loan can expedite the homebuying process, as there is no need for the buyer to go through the loan approval process again.

Benefits for Sellers:

Increased marketability: Offering an assumable VA loan can make a property more appealing to potential buyers, potentially leading to a quicker sale.

Potential for better terms: Sellers may be able to negotiate a higher sales price or other favorable terms by offering an assumable VA loan as an incentive.

Avoidance of prepayment penalties: Since the loan is being assumed rather than paid off early, sellers can avoid any prepayment penalties that may be associated with their existing loan.

Potential Drawbacks for Both Parties:

Transferability restrictions: Not all VA loans are assumable, and those that are may have restrictions on who can assume them or under what conditions.

Responsibility for existing loan terms: The assuming borrower inherits the remaining balance and terms of the VA loan, including any potential drawbacks or limitations.

Limited loan options: Buyers may have fewer loan options available to them if they choose to assume a VA loan rather than seek out a new mortgage with potentially more favorable terms.

Process of Assuming a VA Loan

Steps Involved in Assuming a VA Loan:

- Verify loan assumability: Confirm with the lender and the VA that the existing VA loan is assumable.

- Qualify for assumption: The assuming borrower must meet the lender’s credit and income requirements and be eligible for a VA loan.

- Obtain lender approval: The seller must obtain approval from their lender to transfer the loan to the buyer.

- Apply for VA loan entitlement: If necessary, the assuming borrower may need to apply for a new Certificate of Eligibility (COE) from the VA.

- Finalize assumption agreement: Once all parties have agreed to the terms, a formal assumption agreement is drafted and signed.

Documentation Required for Loan Assumption:

Assumption agreement: A formal agreement outlining the terms and conditions of the loan assumption.

Proof of eligibility: Documentation proving the assuming borrower’s eligibility for a VA loan, such as a COE or military service records.

Financial documents: Income verification, bank statements, and other financial documentation to demonstrate the assuming borrower’s ability to repay the loan.

Tips for Smoothly Navigating the Assumption Process:

Work with experienced professionals: Consult with a knowledgeable real estate agent and lender who have experience with VA loan assumptions.

Understand the terms: Review the existing loan terms carefully to ensure that they are favorable and align with your financial goals.

Communicate openly: Maintain open communication with all parties involved in the assumption process, including the lender, seller, and assuming borrower, to address any questions or concerns promptly.

Frequently Asked Questions (FAQs) about VA Loan Assumability

Common Queries from Borrowers:

- Can anyone assume a VA loan?

Only qualified borrowers who meet the VA’s eligibility requirements can assume a VA loan. This typically includes veterans, active-duty service members, and eligible surviving spouses.

- Are there any fees associated with assuming a VA loan?

While there are typically no assumption fees charged by the VA, the lender may charge a processing fee for facilitating the assumption.

- What happens to the seller’s entitlement after a VA loan assumption?

The seller’s entitlement may be restored once the loan is assumed by a qualified buyer, allowing them to potentially use their VA loan benefit again in the future.

- Can the terms of a VA loan be modified during the assumption process?

Generally, the terms of the VA loan remain unchanged during the assumption process. However, certain modifications may be possible with lender approval.

Clarifications on VA Loan Assumption Policies:

- Are there any restrictions on who can assume a VA loan?

Yes, assuming borrowers must meet the lender’s credit and income requirements and be eligible for a VA loan.

- Can the interest rate on an assumed VA loan be renegotiated?

No, the interest rate on an assumed VA loan remains unchanged from the original terms of the loan.

- What steps are involved in obtaining lender approval for a VA loan assumption?

The assuming borrower typically needs to submit financial documentation and undergo a credit review to ensure they meet the lender’s requirements.

Common Misconceptions and Myths:

Myth: VA loans are difficult to assume.

Reality: While there are certain requirements and procedures involved, assuming a VA loan can be relatively straightforward with the help of experienced professionals.

Myth: Assumable VA loans have higher interest rates.

Reality: The interest rate on an assumable VA loan is typically the same as the original loan terms, which may be lower than prevailing market rates.

Myth: Assumable VA loans are only for veterans.

Reality: While VA loans are designed to benefit veterans, active-duty service members, and eligible surviving spouses can also assume VA loans if they meet the necessary criteria.

Recap of Key Points:

VA loans are assumable under certain conditions, allowing qualified borrowers to take over the existing loan from the seller.

Assumable VA loans offer potential benefits for both buyers and sellers, including lower interest rates and reduced closing costs.

Understanding the process and requirements for assuming a VA loan is essential for a smooth and successful transaction.

Expert Advice

Due to the complexities involved in VA loan assumptions, it’s crucial for buyers and sellers to seek guidance from experienced real estate professionals and lenders. Working with experts who specialize in VA loans can help ensure that all parties understand their rights and responsibilities throughout the assumption process.

Final Thoughts on VA Loan Assumability

VA loan assumability can be a valuable tool for both buyers and sellers in the real estate market. By understanding the process and potential benefits, borrowers and sellers can make informed decisions that align with their financial goals and objectives. As with any significant financial transaction, careful consideration and expert guidance are key to achieving a successful outcome.

Your VA Home Loan Journey

With over three decades of experience, Rob Sturms is a trusted name in Colorado’s mortgage industry. Since 1993, he’s been guiding clients with honesty and expertise through various loan options, ensuring personalized solutions for each homeowner’s journey. As the founder of Rob’s Mortgage Loans, Rob’s commitment to transparency and tailored service makes him the go-to choice for reliable lending assistance.

Ready to secure your dream home? Contact Rob today to get started!